Investment Case

Purpose-built to grow and compound value from digital assets and decentralised infrastructure.

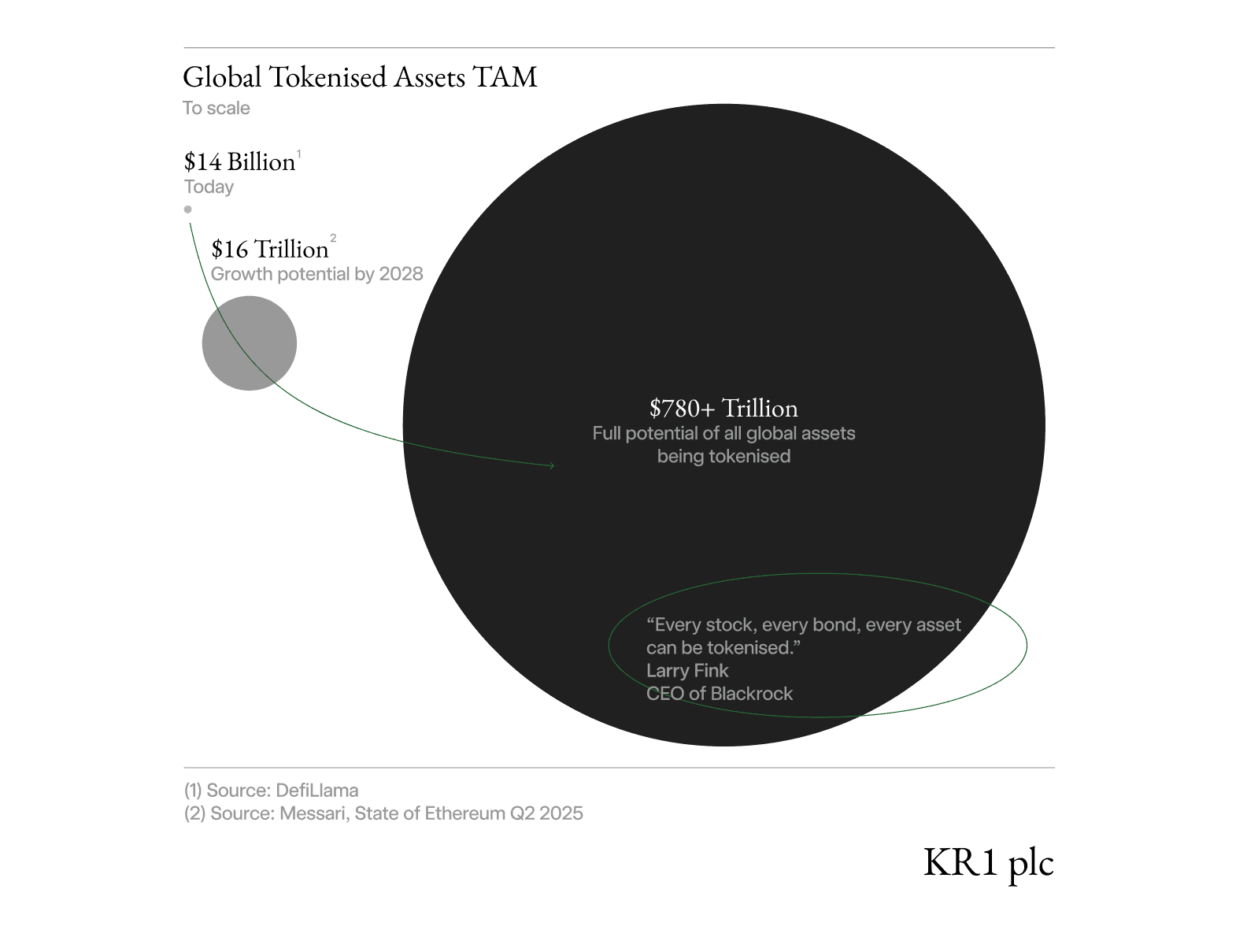

A structural migration of assets onto blockchain rails is underway. More than $300 billion in stablecoins already circulate on public networks, benefiting from the efficiency and programmability of decentralised systems. The U.S. Treasury projects that the stablecoin market alone could reach $2 trillion by 2028, part of a wider shift that, as BlackRock CEO Larry Fink notes, could see every stock, bond and asset eventually tokenised.

Meeting the growing demand for tokenised assets requires robust, scalable and open blockchain infrastructure. KR1 plc brings decades of combined experience within the digital asset ecosystem, having seed-funded and supported a number of foundational infrastructure projects. The company has refined a repeatable process for identifying high potential networks, allocating capital with conviction and converting network participation into income, evidenced by £12.8 million in income for FY2024 on a NAV of £139.4 million (FY2024). Structurally distinct from passive crypto instruments, KR1 plc has operationalised income generating strategies within emerging networks, compounding its digital asset base while retaining long-term exposure to the growth of the onchain economy.

As an example, the Company made an early investment in Lido in 2020, a platform that pioneered ‘liquid staking,’ enabling staked assets to remain productive across other blockchain applications. Lido has since become the largest staking platform on Ethereum, with more than $30 billion in total value locked. In addition to holding LDO, the platform’s core network token, KR1 plc stakes the majority of its ETH holdings, directly contributing to the security and performance of the Ethereum network. This activity, fundamental to Ethereum’s proof-of-stake consensus protocol, rewards the Company with additional ETH. Staking on Ethereum and other proof-of-stake networks now account for the majority of the KR1 plc’s income, exemplifying how the Company converts network participation into ongoing, compounding value — a strategy it intends to broaden through additional forms of network level activities consistent with its technology driven mandate.

KR1 plc’s advantage lies in its ability to identify and build conviction in emerging blockchain networks, supported by deep domain knowledge and operational expertise that enable the Company to deploy income generation strategies to capture value from its underlying asset base. For investors, KR1 plc provides an institutional-grade vehicle for exposure to the growth of digital assets and decentralised infrastructure.